The impact of construction and material lead times on your projects

Americas preconstruction principals, Rose Williams and Richard Wilson bring insight into the current construction market to provide guidance in your decision making.

With all the uncertainty in the market, our clients want to know how it will impact their projects. To guide them, we’ve analyzed and collated information covering the current state of the market.

We’ve provided an understanding of the drivers to increasing material and labor costs on construction projects, and recommendations on how to minimize risk and manage cost increases from the outset of a project.

So, how did we get here?

The top three reasons prices aren't what you expected, or budget for.

1. Transportation costs

Driver wages, shipping, fuel, equipment, maintenance, and insurance coverage tend to go up each year. With the continual effects of Covid-19, the logistics industry is experiencing the highest constant peak in increased cost ever.

Challenges of securing ocean capacity amid current logjams and prospects of hugely inflated ocean freight costs in 2022 are forcing logistics buyers to consider radical options. And while the crisis has turned ocean transportation into an unreliable sector, luckily, we have seen some easing on month-to-month rising costs in Q2 2022.

2. Labor and material costs

When the pandemic hit, the construction industry lost 1.1 million employees within two months. By July 2021, 4.5% of construction jobs were unfilled, totaling about 347,000 jobs.

To attract, retain, and bring back their workers, construction firms have had to significantly raise pay. And it's evident that pay raises will need to increase in the coming months to remain competitive.

With the rise in labor costs comes a rise in materials costs. According to the latest Bureau of Labor Statistics, PPI report, the prices of goods used in residential construction show a 4.9% increase in building materials prices since the start of 2022. Building material prices are up 19.2% year-over-year and have risen 35.6% since the start of the pandemic.[1]

3. Taxes

Import taxes and duties, which include tariffs, are another huge cost factor. The U.S. is currently carrying 25% tariffs on steel imports against many nations, creating artificial impediments to the free-market system.

The industry anticipates input costs pressure to remain high over the next two years, with some expectation that the pace of the cost increases will slow. When planning for the coming year, keep in mind that various raw materials and equipment carry additional tariffs when imported into the U.S.

What does this mean for the rest of the year?

The U.S. is currently one of the top five most expensive countries in the world to build[2] due to labor shortages, supply chain disruption, and material escalation on a global level.

But despite challenges, we anticipate that the construction industry will remain strong throughout the second half of 2022.

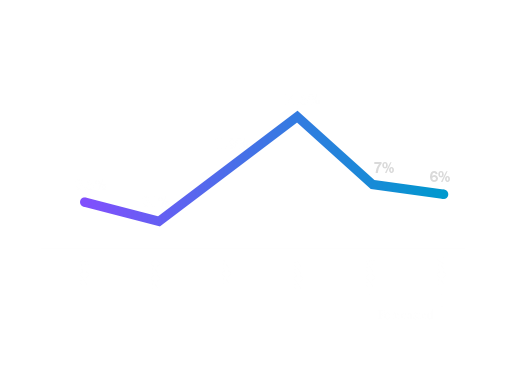

Our construction cost data shows an average input cost increase of 14.5% (Figure 1) over the last 12 months. We do expect construction cost escalation to continue to increase at rates above national levels, albeit slower than seen over Q1 and Q2 of 2022.

Figure 1: Unispace construction cost data

Solution

There is a lot of emphasis on trying to predict future outcomes and forecasting possible trends going forward as clients try to mitigate risks on their projects. This begs the following questions:

Who bears the risk of these price escalations? And how can construction stakeholders mitigate these risks?

To answer these questions and learn more about the current state of the market, download the full Unispace construction market analysis whitepaper.

[1] NAHB - Building Materials Prices up More than 19% Year over Year (May, 2022)

[2] World Construction Today - The 10 Most Expensive Cities In The World to Construct In (July 2022)