How will offices fare in the Covid-19 recession?

In 2020 the pandemic made its way across globe, forcing offices to close and causing people to lose their jobs. The result? A global recession of which the scale is yet to be revealed. Not unlike past recessions, we expect it will gather its own identity and momentum.

In the last recession series article, When will we see green shoots?, we explored the inter-relationship between recessions and the commercial real estate market. In this article, we’ll dive deeper, looking specifically at the sensitivity of offices to economic downturns and examine some sectors most affected by the pandemic including the service industry (hospitality, retail etc.). We’ll assess the short-term risk on the office market and discuss some of the trends that have accelerated from the shift to remote working.

Offices and the service economy

Historically, when the world was more agriculturally and then industrially led, recessions hit trade sectors like car and steel production, fishing, mining, and shipbuilding, the hardest. For this reason, Detroit, America’s industrial heartland, is said to have never fully rebounded from the global financial crisis (GFC) of 2007-9. Now, in our current economic downturn, the service sector leads the way.

In 1947, manufacturing was the most important factor of the American economy, contributing to almost 26% of GDP. Fast-forward seventy years to 2018, and a completely different economic landscape. Finance, insurance and real estate sectors have moved to the top, holding 21% of GDP, with professional and business services close behind at 13%.

A similar pattern can be seen across the world. In 2018, the service sector accounted for 61.2% of global GDP, with industrials contributing just 27.8% . Fun fact, in the UK today, there are six times more fitness instructors than fishermen .

Why does this matter? When the US economy was enjoying its longest sustained expansion in history, services did most of the heavy lifting. The industry was expected to continue to provide the economy with sustained growth, especially given strong consumer and business confidence. This demand for services output drove office space growth. When the pandemic caused a global shutdown, halting consumer spending and investing, it significantly affected the office market. As offices remain closed or functioning at a significantly lower capacity, industries within services continue to be impacted. As we noted in the last article, recessions follow periods of over-supply, and when downturns come, investment in non-residential developments tend to dip sharply.

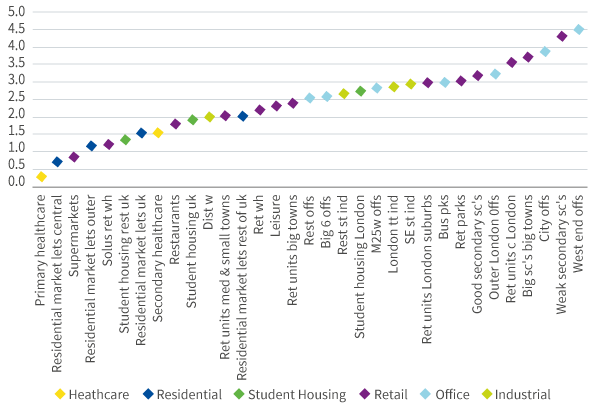

When we look at the impact of the UK’s GDP on commercial property, we see similarities to the US market. The chart below indicates the sensitivity level of various types of commercial property. Unsurprisingly, the least sensitive sectors are primary healthcare, rented housing, and supermarkets. Following Maslow’s hierarchy of needs, these sectors as essential for basic human survival. On the far right of the chart, you can see offices, business parks and retail centres, with prime London (City and West End) office sectors, are the most sensitive to change.

Source: PMA, Aviva Investors, April 2020

What can past recessions tell us about office values?

According to a report by the US National Council of Real Estate Investment Fiduciaries (NCREIF) reviewing the impact of recessions on commercial real estate values, US office real estate saw the second-biggest drop in value after the GFC of 2007-2009, and was second-last to recover, after hotels. Some of the impacts included vacancy rates sky-rocketing to 17.4% (Q2 2010), the market losing close to 1.8 SQFT. of occupied space (the highest level since 1993), and pricing for non-residential US properties plummeting by 31.5%.

Recently Savills compared the impact of the GCF on the European office market to the current Covid-19 recession. During the GFC, vacancy rates in the main European office markets rose from 7.9% to 9.6% between 2007 and 2009. This was followed by a drop in prime rents by around 18%. Sentiments about the current office environment are more upbeat, indicating they feel the prospect of prime rental declines to the same extent during the GFC, are unlikely.

The current recession vs. past recessions and the office market

The Covid-19 recession is very different than past recessions, for starters, we weren’t due to have a recession (although many had predicted one on the horizon). Going off the theory of the 18-year cycle, our next recessions should have been in 2025. This means Covid-19 sliced into the natural 18-year cycle. In August, the University of Denver found that in Q2 2020, a majority of the biggest US real estate markets were in the Expansion phase, some were in Recovery, only a few were in Hyper-Supply, and none were in Recession. This indicated there wasn’t enough hyper-supply to have generated an organic recession yet.

In addition, effects on the real estate markets and the usual pattern of office occupancy was immensely disrupted by the pandemic. From layoffs, to furloughs, and the massive shift to remote working, office occupancy has remained very low. This has led employees and businesses alike to reconsider the benefits of home-working, causing companies to re-examine their real estate needs and look at emerging trends.

Emerging real estate trends: flexibility, flexibility, flexibility

As uncertainty continues, flexibility has proven to be an essential feature to the “next normal”. Co-working, hub and spoke office models, and creatively repurposing office space are a few attractive options for companies to consider until they understand how people will return to the office, the frequency, location, etc. and how the office market will pan out. Whether it’s in an existing space, hubs close to where their staff live, or where new, untapped talent pools can be found, the next normal is about mapping out solutions to meet immediate needs, save on costs, and mitigate risk.

Keeping an eye on your short-term risks

With many offices spaces currently vacant or partially occupied, it’s harder to keep an eye on things. After the GFC, Zurich published a 2011 report about the lingering effects on commercial real estate. They found vacant spaces are at risk for various damages that go unnoticed and can cause costly repercussions. Other risks include exposure to surrounding tenants’ issues, maintenance and building responsibilities usually upheld by the landlord.

The Zurich report also found lawsuits between buyers and developers increased as a result of the GFC. These included complaints of “breach of contract or unfair dismissal, discrimination claims, wage and hour lawsuits, and workers compensation”– with both sides likely to sue the other for frustrations or breach of contract.

Many things are unknown with the Covid-19 recession. Some things we do know: the office market (investment as well as rental pricing) is very sensitive to drops in GDP, many workers have continued air on the side of remote/home-working versus coming into the office, and many companies have been taking a “wait and see” approach to making any long-term changes. As the recession continues and the impact to the office market unfolds, cost savings, flexibility, and risk mitigation will be at the forefront of decision making.

Preparing for the storm

The next article in the recession series is coming soon! In “Weathering the current ‘perfect storm’ we’ll share actionable steps for executives to implement in their real estate strategy and thrive in our current environment.

Connect with a team member to learn how you can future proof your real estate strategy with our workplace framework for the future, Propeller. |